iowa homestead tax credit application

Learn About Sales Use Tax. The Homestead Tax Credit is available to all homeowners who own and occupy the residence.

Fill Free Fillable Forms State Of Iowa Ocio

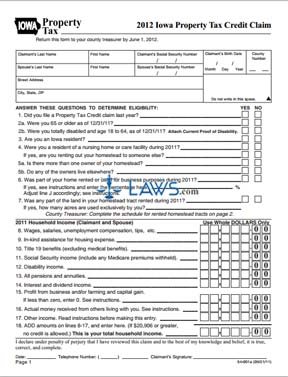

Application for Homestead Tax Credit Iowa Code Section 425.

. File a W-2 or 1099. Homestead Tax Credit Iowa Code Section 42515. Ad Select Popular Legal Forms Packages of Any Category.

Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. All Major Categories Covered. Iowa assessors addresses can be found.

54-028a 090721 IOWA. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028.

Upon filing and allowance of the claim the claim is allowed on that. 54-028 012618 IOWA. Upon filing and allowance of the claim the claim is allowed on that.

Either way you must apply for the homestead tax credit as its benefit is not automatic for homeowners in Iowa. Danilson Law advises buyers to apply for the homestead tax credit within 30 days of closing on your purchase as life gets busy and this is one benefit that you either claim or your dont receive if the deadline passes. Visit our website at.

This application must be filed with your city or county assessor by July 1 of the assessment year. Learn About Property Tax. 54-019a 121619 IOWA.

4 BE IT ENACTED BY THE GENERAL ASSEMBLY OF THE STATE OF IOWA. It must be postmarked by July 1. Under Real Estate Search enter your property address.

Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1. Register for a Permit.

Change or Cancel a Permit. Senate File 2299-Introduced SENATE FILE 2299 BY BOULTON A BILL FOR An Act relating to the disabled veteran homestead tax credit 1 and the military service property tax exemption and credit 2 and including effective date applicability and retroactive 3 applicability provisions. Apply online on our website 1.

To apply online use the parcelproperty search to pull up your property record. E-File Your Tax Return Online - Here. This application must be filed or postmarkedto your city or county assessor on or beforeJuly 1 of the year in which the credit is first claimed.

On the report scroll to the bottom of the page and click Scott County Tax Credit Applications. Ad Free IRS E-Filing. It is a one-time only sign up and is valid for as long as you own and occupy the home.

This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount which does not allow the taxable value to be. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. You do not currently have a Homestead credit on your property and arent claiming Homestead anywhere else How to Apply.

Click on the appropriate credit in this case the Homestead Tax Credit. Upon filing and allowance of the claim the claim is allowed on that. Upon filing and allowance of.

When you are in the parcel that your home is on next to Submission click on Homestead Tax. It must be postmarked by July 1. Browse Legal Forms by Category Fill Out E-Sign Share It Online.

Upon filing and allowance of the claim the claim is allowed on. It must be postmarked by July 1. For additional information and for a copy of the application please go to the Iowa Department of Revenue web site.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Application for Homestead Tax Credit Iowa Code Section 425. INSTRUCTIONS FOR HOMESTEAD APPLICATION The Homestead Tax Credit application must be delivered to the County Assessor on or before July 1.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

54-049a 080118 IOWA. This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed. 5 TLSB 5051XS 2 89.

Homestead Tax Credit Iowa Code chapter 425.

Apply For Homestead Tax Credit Now

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

Form 59 458 Fillable Homestead Tax Military Service Credit Notice Of Transfer Or Change In Use Of Property

The Farm Iowa Farms Farm Scene Farm Photography

Free Form 1154001 Iowa Property Tax Credit Claim Free Legal Forms Laws Com

In This Episode We Ll Discuss Iowa S Disabled Veterans Homestead Tax Credit And Other Tax Exemptions Available To Disable In 2020 Disabled Veterans Disability Veteran

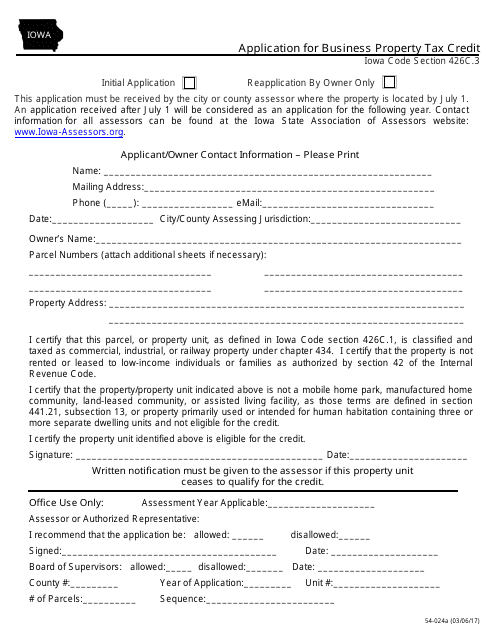

Form 54 024a Download Fillable Pdf Or Fill Online Application For Business Property Tax Credit Iowa Templateroller